How to Use Furusato Nozei for Beginners – Simple Guide to the System and Key Tips

Furusato Nozei lets you support local communities while receiving valuable thank-you gifts. The process may seem complex at first, but it's actually straightforward once you know the steps.

This guide walks you through Furusato Nozei using the popular platform “Satofull”. It shows exactly how the system works.

Follow along and you'll be able to get started with Furusato Nozei smoothly.

Furusato Nozei is open to everyone living in Japan with tax obligations—including foreign residents. With resident registration and tax payments, you can join, support local communities, and receive thank-you gifts.

Beginner’s Guide: How to Use Furusato Nozei with “Satofull”

In this article, we’ll show you how to make a Furusato Nozei payment using “Satofull”, one of the most popular platforms.

Even if you use a different website, the basic process is generally the same, so this can still be used as a reference.

Here are the typical steps:

- Check your Furusato Nozei deduction limit

- Choose a municipality based on the thank-you gift or region

- Complete your payment on the platform

- Receive a payment receipt from the municipality

- Get your thank-you gift delivered

- Submit the required forms to claim your tax deduction

Check your Furusato Nozei deduction limit

The first step is to check your Furusato Nozei deduction limit.

Your deduction limit depends on your income and household size. Payments above this limit won't be eligible for a tax deduction.

You can estimate your limit using a simulator on sites like “Satofull.” Just enter your expected annual income and household status as of December 31.

The tool will show you the maximum amount you can use for Furusato Nozei. For example, if you're single and earn ¥4 million a year, your limit is about ¥39,000.

If you’re self-employed or have performance-based income, it’s best to use a conservative estimate when calculating your limit.

Furusato Nozei Deduction Limit Simulation by Income

The table below shows estimated Furusato Nozei deduction limits based on annual income, using data from Satofull’s simulator.

| Annual Income (JPY) | Single or Dual-Income Household | Dual-Income + 1 Child (under 15) | Single-Income + 1 Child (under 15) |

|---|---|---|---|

| 3,000,000 | ¥25,000 | ¥25,000 | ¥16,000 |

| 4,000,000 | ¥30,000 | ¥39,000 | ¥30,000 |

| 5,000,000 | ¥45,000 | ¥57,000 | ¥45,000 |

| 6,000,000 | ¥64,000 | ¥74,000 | ¥64,000 |

| 7,000,000 | ¥81,000 | ¥104,000 | ¥81,000 |

| 8,000,000 | ¥115,000 | ¥126,000 | ¥115,000 |

| 9,000,000 | ¥138,000 | ¥149,000 | ¥138,000 |

| 10,000,000 | ¥162,000 | ¥173,000 | ¥162,000 |

| 15,000,000 | ¥365,000 | ¥365,000 | ¥365,000 |

In this table:

- “Dual-income household” assumes the spouse earns at least 2.01 million yen annually.

- “Single-income household” assumes the spouse is not earning an income.

- All cases with a child assume one dependent under age 15.

Actual limits may vary depending on your child’s age and family situation.

For the most accurate results, use a simulator on your chosen platform based on your current household.

Choose a Municipality based on the thank-you gift or Region

Next, choose a municipality to make your Furusato Nozei payment.

You can decide based on any reason—whether it's thank-you gifts like premium meat or seafood, or a place with personal meaning such as your hometown or current residence.

If you are a salaried employee and plan to use the One-Stop Exception System—a simplified process for claiming tax deductions without filing a full tax return—you can make payments to up to five municipalities per year.

Complete your payment on the platform

After choosing a municipality, proceed with your Furusato Nozei payment. Available methods include:

- Credit card

- Convenience store payment

- Pay-easy (bank transfer service)

- Amazon Pay

- PayPay (online payment service)

Credit card payment is recommended. Once you register your card details, future payments are quick and easy.

You can also earn reward points from your credit card company. Debit cards are accepted as well.

After payment, you’ll receive a confirmation email from the platform. This confirms your payment was successfully processed.

Receive the Payment Receipt from the Municipality

You’ll receive a payment receipt by mail from the municipality, usually before the thank-you gift. It may arrive as an envelope or postcard.

The payment receipt serves as official proof that your Furusato Nozei payment has been completed.

【Sample of a Furusato Nozei Payment Receipt】

This receipt is essential for claiming your tax deduction. Be sure to keep it safe—even if you use the One-Stop Exception System, you may still need it later, such as if your application is incomplete or rejected.

Receipts are usually sent within 2 weeks to 2 months after payment, depending on the municipality. Check your chosen platform for estimated delivery times.

Get your thank-you gift Delivered

Your gift will be delivered after the payment receipt arrives. Most deliveries are handled by Yamato or Sagawa Express.

If you selected perishable foods or large items, specify a delivery date and time to receive the package smoothly.

Prepare storage space in advance, especially for food or bulk household items like paper products or detergent, as they can take up considerable space.

Submit the Required Forms to Claim your Tax Deduction

After completing your payment, you need to apply to receive your tax deduction.

There are two ways to apply:

- One-Stop Exception System

- File a Tax Return

Option1: One-Stop Exception System

For salaried employees or pensioners who don’t need to file a tax return. Check your eligibility and requirements in the table below.

| Item | Details |

|---|---|

| Eligibility | You meet one or more of the following: - Salaried employee or pensioner who doesn't need to file a tax return - Income from a single employer - Annual salary of ¥20 million or less - No other sources of income - Payments to up to 5 municipalities only |

| Required Documents | Choose one of the following options: - Option A: Copy of My Number Card (front and back) - Option B: ・Copy of My Number notification card OR copy of residence certificate ・Copy of driver's license OR copy of passport - Option C: ・Copy of My Number notification card OR copy of residence certificate (choose one) ・Two copies from: health insurance card, pension book, or other official documents recognized by the municipality (choose two) |

| How to Apply | Send the application form and ID documents to each municipality |

| Tax Deduction Type | Deduction from resident tax only |

| Submission Deadline | Must arrive by January 10 of the following year |

References:

National Tax Agency: Information for Furusato Nozei Contributors

Option2:Filing a Tax Return

If you're self-employed or have side income, you must file a tax return using the Furusato Nozei payment receipt.

Check your eligibility and requirements in the table below.

| Item | Details |

|---|---|

| Eligibility | You meet one or more of the following: - Self-employed - Receive income from two or more sources - Annual salary exceeds ¥20 million - Have income other than salary - Donated to more than 5 municipalities - Plan to file a tax return |

| Required Documents | - Furusato Nozei payment receipt (or related data) - My Number card - Proof of income - Documents required for each deduction type - Bank account information |

| How to Apply | - e-Tax (online) - Postal mail |

| Types of Tax Deduction | - Income tax refund |

| Filing Period | For 2024 tax year: February 17, 2025 (Mon) to March 17, 2025 (Mon) ※ Dates may vary slightly each year |

Reference:

National Tax Agency: Information for Furusato Nozei Contributors

National Tax Agency: 2024 Income Tax Return Filing Guide - Required Documents for Tax Return Filing

You can get deductions for your full payment, except for the mandatory ¥2,000 personal cost.

The required documents depend on the type of deduction you are applying for. Be sure to check which ones are necessary in your case.

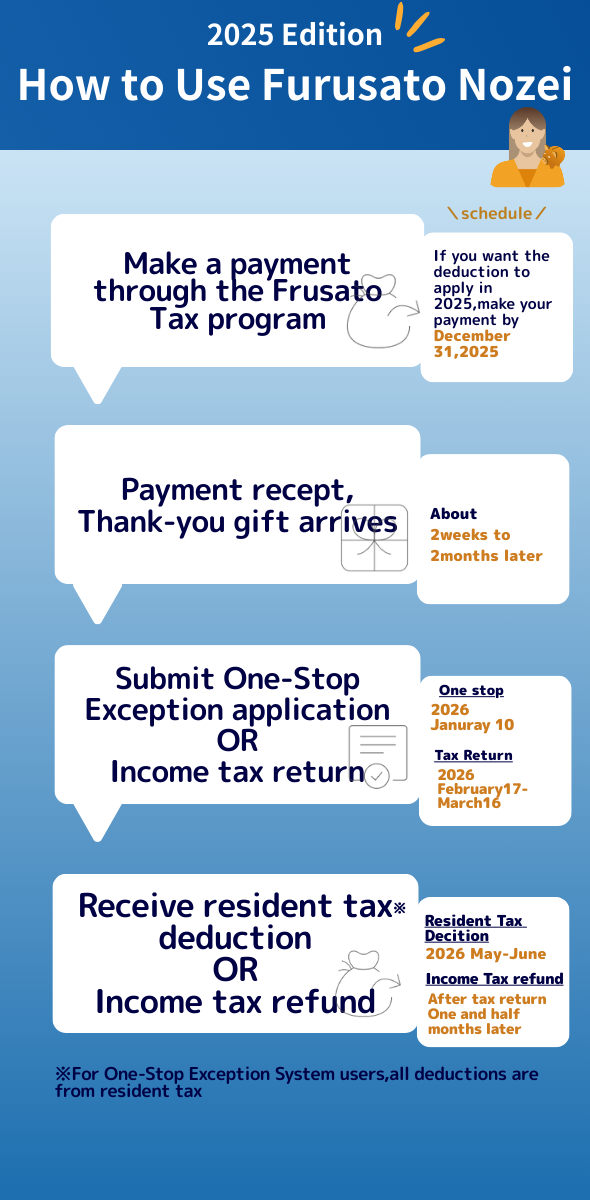

2025 Furusato Nozei Timeline and Key Dates

To help you plan, here’s a visual summary of the Furusato Nozei process and schedule for 2025.

Popular thank-you gifts are limited in stock, so it's best to make your payment as early as possible.

The point reward system for Furusato Nozei will end on October 1, 2025.

Reward points can only be earned for payments made by the end of September 2025, so a last-minute rush of payments is expected before the September deadline.

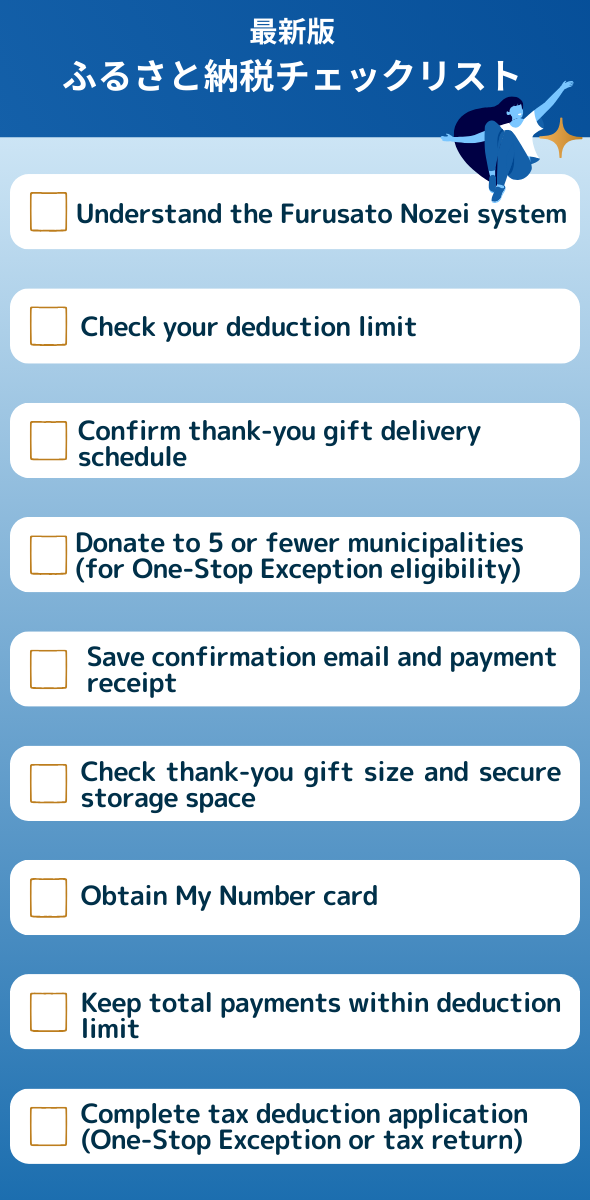

Checklist for First-Time Furusato Nozei Users

If you're using Furusato Nozei for the first time, here’s a universal checklist that applies to any platform.

Before and After Making Your Payment:

If you can check off all the items above, your Furusato Nozei process is complete—with no mistakes.

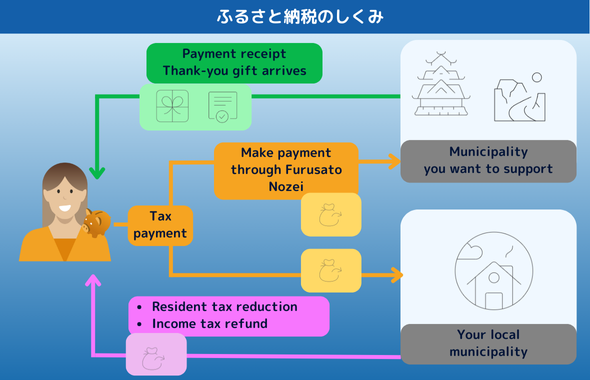

Visual Guide: How Furusato Nozei Works

Furusato Nozei lets you support local municipalities and receive thank-you gifts in exchange.

Instead of paying all your taxes to your local municipality with no benefits, you can make Furusato Nozei payments to other regions.

In return, you receive thank-you gifts worth about 30% of your payment.

Example:

With an annual income of ¥6 million, you could make Furusato Nozei payments of around ¥60,000.

- Your cost: ¥2,000

- Tax refund/deduction: ¥58,000

- Gifts received: ¥18,000 worth (meat, seafood, fruits, household goods)

- Regular taxation: No gifts

Despite requiring some paperwork, Furusato Nozei offers excellent value and is worth considering.

Common Pitfalls for Furusato Nozei Beginners and Solutions

Here are typical mistakes beginners make when starting Furusato Nozei and how to avoid them.

💴Underestimating the Upfront Costs

To receive higher-value thank-you gifts, you’ll generally need to make payments of ¥10,000 or more.

While some platforms allow contributions from as low as ¥1,000, the value of the thank-you gift is capped at around 30% of your payment. This means smaller payments often result in lower-quality gifts.

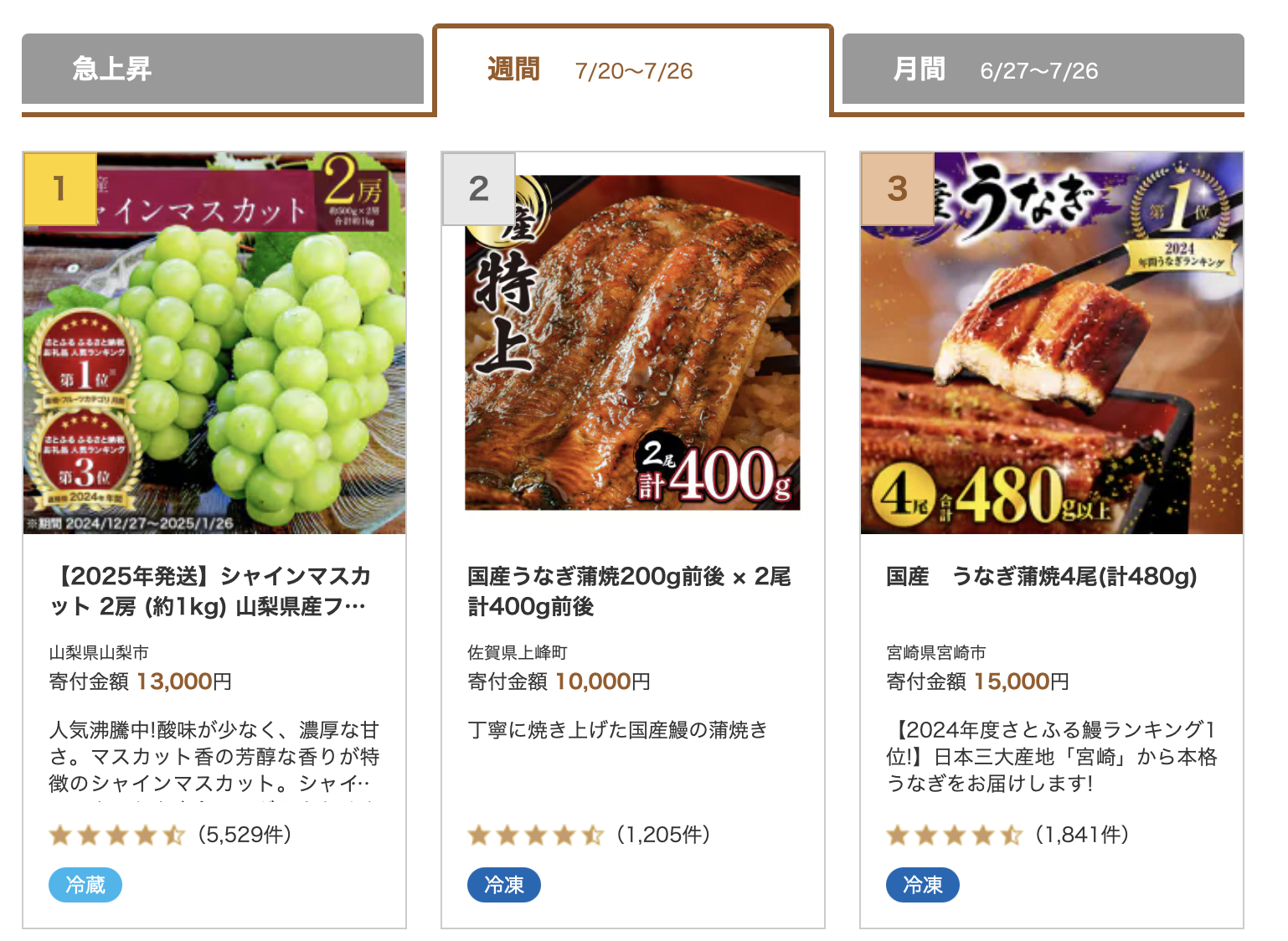

For example, popular thank-you gifts ranked on Satofull’s weekly list are typically in the ¥10,000+ range.

Source: Satofull | [2025 Latest] Furusato Nozei Popular thank-you gifts Recommended Rankings (Weekly)

If you plan to support multiple municipalities, your total payments could easily reach ¥50,000 to ¥100,000.

To avoid financial strain, consider spreading payments over several months.

🙄Forgetting to Complete Tax Deduction Procedures

The biggest mistake beginners make: forgetting to complete tax deduction paperwork.

Without proper applications, your Furusato Nozei payment becomes just an expensive purchase with no tax benefit.

Critical Deadlines:

| Method | Deadline |

|---|---|

| One-Stop Exception System | January 10 (following year) |

| Tax Return Filing | Feb 17 – Mar 17 (2025 for 2024 payments) |

If you miss the January 10 deadline for the One-Stop Exception System, you’ll have to file a full tax return instead—which requires more effort.

To avoid this, be sure to set reminders or mark your calendar so you don't miss the deadline.

🚨Exceeding Your Deduction Limit

A common mistake is going over your Furusato Nozei deduction limit. Any excess amount won’t qualify for tax deductions and will be treated as a regular donation.

Extra Caution Needed:

- Self-employed individuals

- Employees with performance-based income (fluctuating annual earnings)

To avoid this problem:

- Use conservative estimates

- Wait until year-end to make large payments

- Check your projected income and deduction limit

- Use your platform’s tracking tool to monitor your total payments

- Leave a small buffer to stay within your deduction limit

Staying within your limit ensures you get the maximum tax benefit for your payments.

💥No Space to Store Delivered Goods

A common problem is receiving bulky items with nowhere to store them. Food items can spoil if there's no fridge/freezer space.

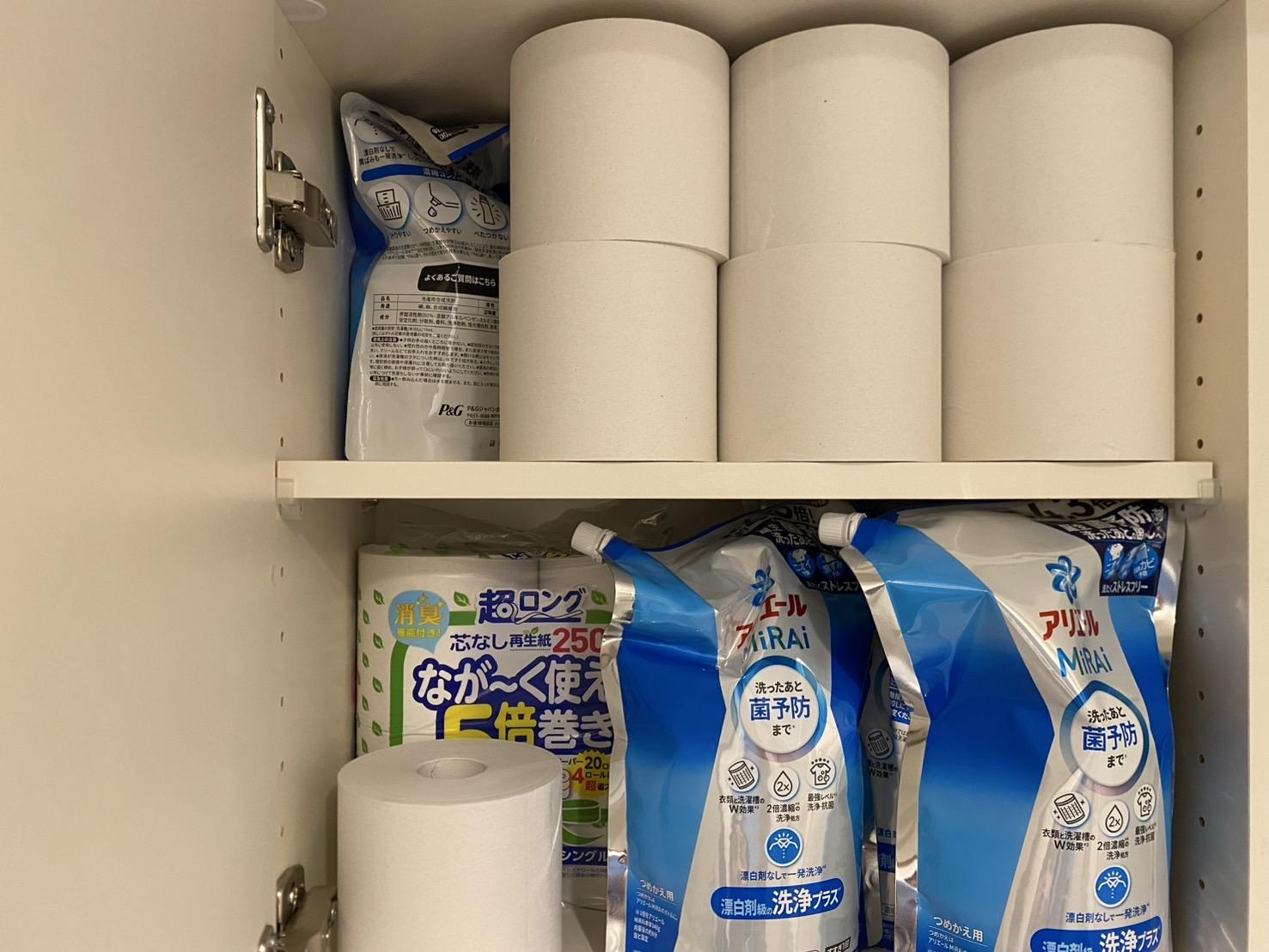

I use Furusato Nozei for daily essentials like toilet paper and detergent. These arrive in bulk, so I always check storage space before ordering.

【Storing bulk toilet paper and detergent received from Furusato Nozei】

Before Ordering:

- Check delivery timing

- Confirm available storage space

- Clear fridge/freezer for food items

Always verify delivery dates and prepare storage space before making payments.

🙅🏻♀️Exceeding the 5-Municipality Limit

A common mistake among salaried workers and public employees is selecting more than 5 municipalities—even when they plan to use the One-Stop Exception System.

This system only applies when you choose 5 or fewer municipalities. If you select six or more, you'll be required to file a full tax return to get your tax benefits.

To keep things simple with the One-Stop Exception, always limit your choices to 5 municipalities or fewer.

Most platforms let you check your history, so review it regularly to avoid going over the limit.

🗓️Missing the Deadline Due to No My Number Card

To use the One-Stop Exception System, you need either a My Number Card or your notification letter plus photo ID.

If you don’t have a My Number Card, your application may be delayed—and you’ll miss the January 10 deadline, requiring a full tax return.

Many people apply too late in December and don’t receive the card in time. Apply by late November to ensure you can use the system without issues.

Common Questions About Furusato Nozei

Here are answers to common questions beginners have about Furusato Nozei.

Q. Does Furusato Nozei reduce my resident tax (offer tax savings)?

A. Not directly. You're paying the same total amount in taxes, but Furusato Nozei lets you choose where part of it goes—and receive thank-you gifts in return.

For just ¥2,000 out of pocket, you get gifts worth around 30% of your donation, which regular tax payments don't provide.

Q. Is it better not to use Furusato Nozei?

A. Furusato Nozei is highly recommended. You’re paying the same taxes, but you get thank-you gifts in exchange.

If you pay ¥60,000, your actual cost is just ¥2,000. The other ¥58,000 is covered by tax deductions you'd be paying anyway.

You also receive gifts worth around ¥18,000—like premium meat, seafood, or household items. With regular taxes, you get nothing in return.

Q. Is there an income level where Furusato Nozei isn't worth it?

A. If your annual income is under ¥1.55 million, Furusato Nozei may not be cost-effective.

Your deduction limit would be under ¥7,000, meaning thank-you gifts worth around ¥2,100 may not justify the ¥2,000 personal cost.

For example, if you pay ¥6,000 and receive gifts worth ¥1,800, you lose ¥200 after the personal cost.

Your deduction limit also depends on your household status. Check simulation tools on Furusato Nozei websites to calculate your potential benefit.

Q. Can foreign nationals use Furusato Nozei?

A. Yes. Foreign nationals can use Furusato Nozei if they have resident registration in Japan and pay income and resident taxes.

There are no nationality restrictions—anyone with tax obligations in Japan is eligible.

It’s Not Too Late. Start Furusato Nozei Today!

Furusato Nozei is easy to use once you understand how it works. By trying it yourself, you’ll quickly see how simple the process is and how much you can benefit.

Start by checking your deduction limit, then search for thank-you gifts or regions you'd like to support.

Complete your application by year-end, you’ll receive the full tax deduction the following year.

It’s not too late—follow the steps in this article and make your Furusato Nozei debut today!

Author:Reo Suyama

Finance and Insurance Writer Certified Level 2 Financial Planner who worked in life insurance sales and management before becoming a freelance writer in 2021. He specializes in real estate, insurance, and tax-related content based on his industry experience.